|

Today's Opinions, Tomorrow's Reality

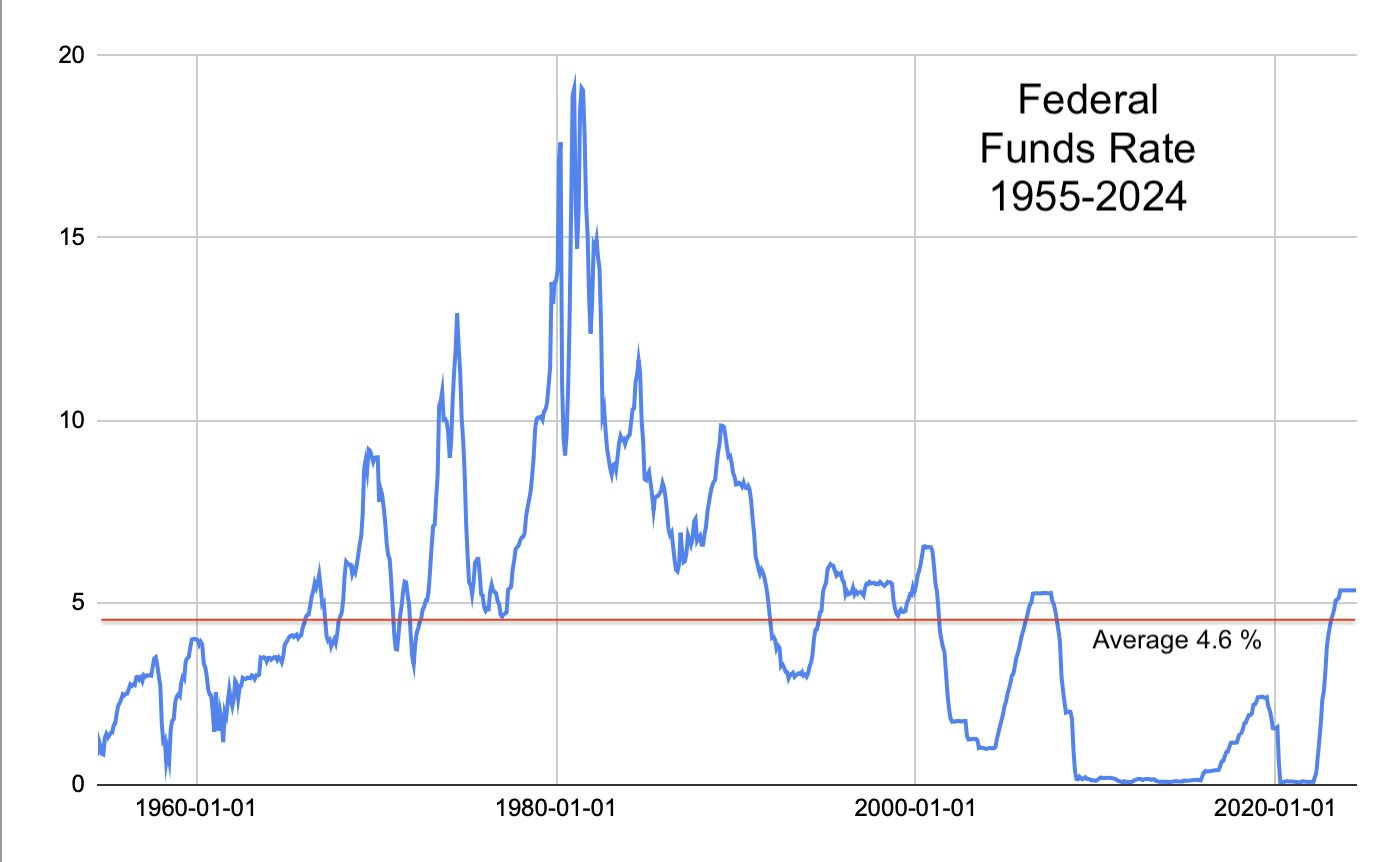

No Going Back By David G. Young Washington, DC, September 3, 2024 -- Interest rates may be going down, but don't expect them to return to easy money levels of the last 15 years. With a widely anticipated rate cut expected from the Federal Reserve's September 18 policy meeting, markets are almost giddy with anticipation. As the stock market hovers near record highs and housing markets doing the same, expectations are that lower borrowing costs will boost business and home sales alike. But will it? Most experts expect a mere quarter point drop in the Federal reserve rate, bringing it to 5.0-5.25 percent, the same rate it was last July and still way way above the 0-0.25 percent rate it was at as recently as late 2021. Barring big economic shocks or bad news suggesting a recession, interest rates won't be going down much soon. A whole generation of investors and homeowners has come of age since the 2008 financial crisis that sent interest rates tumbling to historic lows. Until the last couple of years, the highest federal funds rate this generation ever experienced was 2.5 percent in 2019 right before the pandemic hit. It just isn't realistic to expect a return to such unusually low interest rates. But that appears to be what is built-in to some analysts' expectations.

Two longer-term trends drive the shift to higher interest rates: higher inflation and higher debt levels. America's national debt supply passed 100 percent of GDP during the pandemic, and is now at the highest point in history including right after the Second World War. Continued deficit spending increases the money supply and fuels inflation. The ebbing of the China-driven globalization trend has ended downward pressure on prices. And with prices still edging up, people holding all that American public debt must demand interest rates in excess of inflation in order to make it worth their while. Bottom line: Dollar denominated interest rates aren't going back to the one percent level -- or even the two to three percent level -- any time soon. Get used to it. Yes, the Fed will likely cut interest rates his month and may do so again this year But while interest rates will go down a bit, they are not going back to the low levels they were at just three years ago. The consequences of this disconnect between expectations and this reality are manyfold. Asset and commodity prices that are boosted by lower rates are artificially inflated. (Think the stock market, home prices, commercial office real estate, prices of gold oil, etc.)2 When people holding these assets finally face reality of interest rates reverting to the mean, expect these asset prices to go down. People and businesses who rely on cheap loans to make ends meet will be disappointed and will face economic pain and perhaps default. Those with piles of cash may do okay, but will in the near term face poor returns from a stock market inflated from years of these unrealistic expectations. Politicians on the right and left will find plenty of opportunities for aid and blame: they can demand debt relief for students and bailouts for developers. They can blame supermarkets for price gouging and foreigners for driving up oil prices. But the real issue here is that there is no free lunch. If you want to borrow money, you have to expect to pay a reasonable fee to do it. And Americans are going to get stuck with those fees for decades of irresponsible spending. Related Web Column: Dictators and Day Traders, May 14, 2024 Notes: 1. Federal Reserve Bank of St. Louis, Federal Funds Effective Rate, as posted September 3, 2024 2. Economist, Will Interest Rate Cuts Turbocharge Oil Prices?, September 2, 2024 |